Steps to Create a Budget and Pay Off Credit Cards

By Jon Mohatt

Why do I (we) need a budget?

In my previous blog, Why Dave Ramsey is Wrong and Costing you Money, I pointed out the importance of paying off your credit cards every month if you are going to use them to accelerate your reward point accumulation. The only way to do this is by ensuring you have the money necessary to pay your credit card bill when you receive your monthly statement. This means you need to be telling your money what to do rather than the other way around. Too many people live paycheck to paycheck without looking to the future by having a plan (aka budget). So, if you have read my Beginner’s Guide and feel like you want to get into the game, welcome, it’s a lot of fun but be forewarned, once hooked you will want to maximize your point accumulation and the fastest way to do that is through credit card bonuses. Don’t even think about using credit cards unless you can pay them off every month. So let’s check out the five easy steps to create a budget to ensure you can do just that.

Keep Your Budget Realistic and Simple

Putting together a budget is not rocket science or even algebra. Creating a budget is more like basic arithmetic. The hard part is getting your significant other (if you have one) to agree to it and staying committed to it! In my case I have an equally committed spouse so we encourage and hold each other accountable to our spending limits. This team approach works out extremely well. If you and your spouse can’t agree then that’s an issue that must be addressed first, it’s just not one I’m going to be any help with on this blog. So, assuming you have a spouse or significant other, and you now agree that you need a budget, let’s get started.

Five Easy Steps to Create a Budget

1 – Calculate your monthly take-home income

This step is probably the easiest in the whole process as all it requires is for you to add up the take-home amount from your current paycheck(s) (times two if paid every two weeks) and any other income sources. This monthly take-home total becomes your overall spending limit for the month. I prefer to budget by the month, and not by paycheck. By following this method you have two months where you will receive an extra (third) paycheck. Treat these extra two paychecks as bonus money and use them to pay down debt or add to savings if already debt-free.

2 – Research your past several months of expenditures

If you don’t already have a method for tracking your monthly expenditures I suggest you put one in place or else you will not know where your money is going, and therefore, not be able to determine compliance with your budget. I use a custom Excel Workbook with multiple tabs to track all my various category expenditures. In the past I have used Quicken by Intuit but found it to be overkill for my purposes so I just developed my own Workbook that has been doing the trick for the past two decades. If you find you want to have more detailed accounting and be able to automate your transition downloads from your credit card(s) and bank(s) then maybe Mint.com, Quicken or a number of other products would be more to your liking. As long as you have a tool to track spending, by category, every month that works for you then that is all you need. Remember, especially starting off, the simpler the better or else you won’t use it.

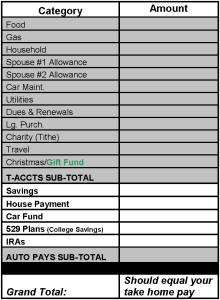

3 – Create spending categories based off historical expenditures and future goals

I have included below the category list our family uses for our budget. It may look overly simple but that is what works for us because we determined early on that we needed flexibility in our budget, otherwise, we would never follow it. I am happy to say that for 2013 our family was 99.547% compliant with our annual budget. Since we had flexibility built into our budget we were able to flex some months and retract others to ultimately come within 0.453% of hitting our annual budget goals. You and your family will have to decide what amounts work for you in each of your categories but once you agree, realize you may be off and will have to adjust over time. We have been doing this a long time and that is why we have become so accurate and don’t allow “extra” expenses that come up throughout the year to derail us. You too will figure out what works best for your situation.

Budget Category Explanations

Some of the categories above require a bit more explanation. The two “Allowance” categories gives each spouse an agreed upon amount of money each month that is theirs to spend as they wish, no questions asked. We have found that this makes those extra shoe, clothing, photography or computer purchases less contentious as long as they come out of one’s own “Allowance”. The Large Purchase (Lg Purch) category is for any unexpected large purchases that may come along. We maintain a pre-defined amount of money in this category and remove any excess at the end of each month by moving it to savings. This is really the key to how we stay on budget even when non-budgeted expenses come up as the most inopportune times. At the end of every month any money left in our spend categories is moved to “Lg Purch” and then any amount in “Lg Purch” above our set limit is moved to savings. The reverse is true as well. If we overspend in a category the deficit is zeroed out for the month by taking from the “Lg Purch” fund. This creates a pressure release valve for our budget when all of a sudden we have to spend $250 for a sport’s camp or prom dress. On months when our “Lg Purch” category drops below our set limit we just don’t move anything out of that category to savings until we get back above our limit. It’s our emergency fund that keeps us from having to ever touch our long-term savings (3-6 months of living expenses). The car maintenance, car purchase, travel and Christmas/Birthday categories are never skimmed and allowed to grow if not spent in a given month as those expenses tend to come less frequently and we always want to have money saved up in them so when it’s time to buy new tires we have that money already saved. The last category that is vital to staying on budget is our “Dues & Renewals” category that pays any and all of our known regularly scheduled bills. We have documented every expense not otherwise listed in the other categories and included it in this category. Some examples include auto insurance, subscriptions, club dues, HOA fees, kid’s activity dues, magazine subscriptions, professional dues and children’s allowance. We have 45 different bills that I know will come up either annually, quarterly or monthly and we track exactly how much that will cost for the year and budget for 1/12 to go into this revolving fund every month. Once again, it eliminates surprises which can kill a budget in a split second. If you plan to send your kid(s) to camp every summer and don’t save for it, then when it comes time to pay he/she simply doesn’t get to go or you blow your budget. Most parents blow their budget so little Johnny or Sally doesn’t get left out, so plan accordingly in advance and have the money saved before you need it. This way you can pay for all these big expenses with your rewards credit card(s) (points, points, points) and pay it off when the bill comes due.

If any of the above doesn’t make immediate sense just leave me a comment and I will explain further. This could easily be an hour-long or more presentation, but I tried to abbreviate a bit to keep the blog entry a manageable size. Just think of the categories as “digital envelopes.” If you’re familiar with Dave Ramsey’s budgeting technique that utilize cash and envelopes then you understand. We just don’t use cash or envelops, we buy everything with credit cards that are then paid off using money out of the appropriate “digital envelopes” that are tracked in our spreadsheet.

4 – Have a family meeting and agree upon limits for each spending category

Having a family meeting is important because you want to agree upon the priorities in your budget. Every family will be a bit different. One family will eat a very basic diet and get by with a smaller food budget than another that may like gourmet cooking and requires much more in their food category. It’s all a matter of priorities. One common personal finance rule is to “pay yourselves first”, or in other words, ensure your savings don’t get jeopardized by the rest of your spending. Tithing comes first for other families so some may set their monthly budget limit as 90% of their gross or take-home pay to allow for a 10% tithe first. Everyone will be different. What is important is that everyone in your family agrees to the limits that are set and works together to find ways to stay within those limits. The main reason I use reward points is to extend my travel budget because travel is important to my wife and I, yet we won’t sacrifice certain higher priority areas just to increase our travel budget. We use points to increase our budget in lieu of taking from any of our other discretionary categories. We now travel twice as much for the same amount of money and you can too! Like Chuck Swindoll says “Each day of our lives we make deposits in the memory banks of our children.” so let’s make lots of memories,

5 – Reset and adjust your budget every month as needed

This final step is often skipped and leads many to abandoning their budgets. Realize up front that a budget is a living document and that there will be mistakes made in estimating amounts required for certain categories and adjustments to category limits will have to be made. Just because one blows their budget the first month doesn’t mean that they should declare budgets as impossible. Instead, make adjustments, find ways to reduce costs and keep working on changing the spending habits that caused you to deviate from your path. Eventually you will find budget figures that follow your priorities, allow for some indulgences and still ensures you spend less than you make every month. Living within your means is the key to staying out of debt and on budget. The great thing is that anyone can still enjoy tons of travel on any budget if done properly!!!

In Conclusion…Get Out of Debt and On a Budget

I wrote this article with the assumption that everyone has a basic understanding of what a budget is and how one is laid out. Since everyone has their own tools for tracking expenses and revenue I didn’t want to get too detailed as there are hundreds of ways to implement and tweak a family budget. The bottom line is that you control your money and it doesn’t control you. If you are in debt, that is obviously something you must address before applying for credit card(s). It’s only after you are debt free, aside from your home, and have a solid realistic budget in place that I would entertain applying for any credit card(s). I highly recommend Dave Ramsey and his debt snowball technique if you are in debt. I hope you have enjoyed my “Steps to Create a Budget” article.

One final and vital key to using credit card(s) is to treat them exactly like debit cards. I will dive into this topic on my next post. By using this technique we have never received a credit card bill we couldn’t pay off the moment it was received.

As always, happy brainstorming and safe travels! Be sure to sign up to be notified of future blogs posts (top of right sidebar), let your friends know about this blog and “Like” the companion Facebook page.

Pingback: How to Pay Off Credit Cards Travel Brainstorm